apelman.online

Overview

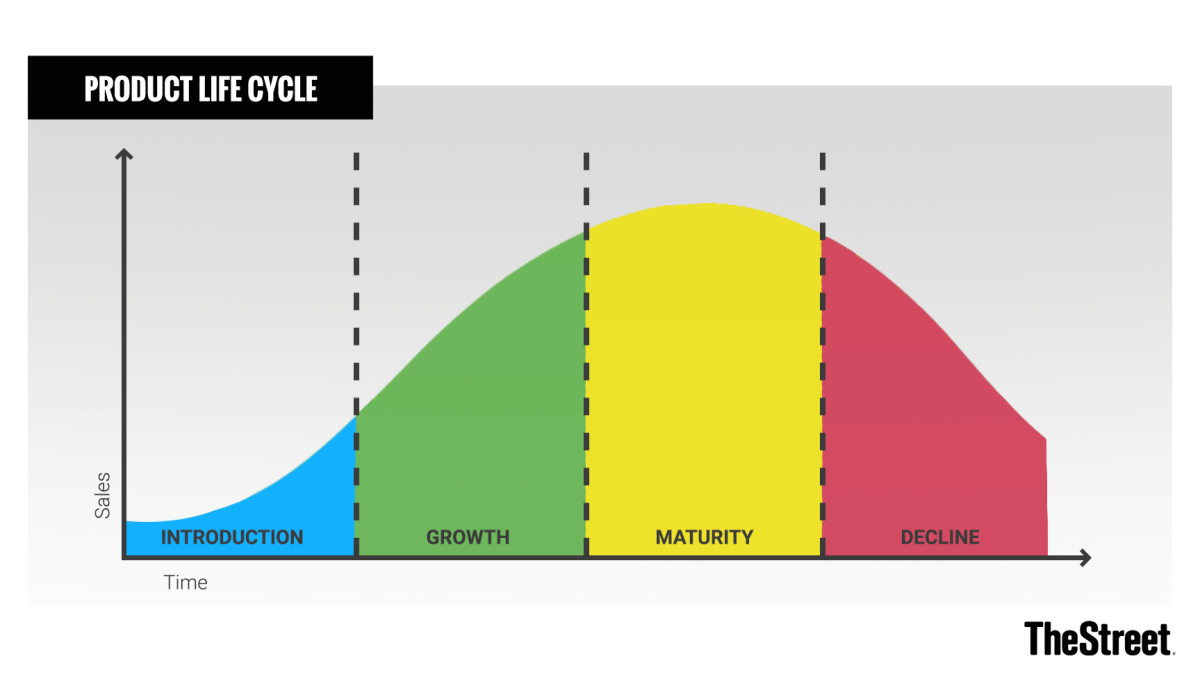

What Is A Product Lifecycle

PLM is the process of managing the entire lifecycle of a product from its inception through the engineering, design and manufacture. More precisely, it describes the development, marketing and sale of the product. Thus, it can be said that the product life cycle forms a kind of framework. The Product Life Cycle (PLC) defines the stages that a product moves through in the marketplace as it enters, becomes established, and exits the marketplace. Product management life cycle in seven main stages: Idea generation and management, research and analytics, planning, prototyping, validation, delivery, and. There are five distinct stages within the product life cycle: development, introduction, growth, maturity, and decline. The product lifecycle is the journey each product takes from the inception of an idea all the way through to a product's retirement. Product life cycle management (PLM) helps businesses plan and execute all aspects of the product life cycle, from design and development through. In this article, we will dive into the topic of product lifecycle management & reveal what steps you can take to cut costs, maximise sales & boost. It systematically structures a company's long-term marketing and product development efforts in advance, rather than each effort or activity being merely a stop. PLM is the process of managing the entire lifecycle of a product from its inception through the engineering, design and manufacture. More precisely, it describes the development, marketing and sale of the product. Thus, it can be said that the product life cycle forms a kind of framework. The Product Life Cycle (PLC) defines the stages that a product moves through in the marketplace as it enters, becomes established, and exits the marketplace. Product management life cycle in seven main stages: Idea generation and management, research and analytics, planning, prototyping, validation, delivery, and. There are five distinct stages within the product life cycle: development, introduction, growth, maturity, and decline. The product lifecycle is the journey each product takes from the inception of an idea all the way through to a product's retirement. Product life cycle management (PLM) helps businesses plan and execute all aspects of the product life cycle, from design and development through. In this article, we will dive into the topic of product lifecycle management & reveal what steps you can take to cut costs, maximise sales & boost. It systematically structures a company's long-term marketing and product development efforts in advance, rather than each effort or activity being merely a stop.

Former Facebook product leader discusses 23 product metrics needed to navigate through all stages of the product life cycle, from development to decline. PLM refers to the management of data and processes used in the design, engineering, manufacturing, sales, and service of a product across the entire. What Are the Five Stages of Product Life Cycle? Every product has a life cycle, running from product development until it is taken off the market. But what are. The product life cycle is the length of time from when a product is introduced to the consumer market up until it declines or is no longer being sold. This. There are five stages in a product life cycle (PLC): development, introduction, growth, maturity, and decline. PLM software is a solution that manages all of the information and processes at every step of a product or service lifecycle across globalized supply chains. The product lifecycle is a strategic concept used in marketing and business management to describe the stages a product goes through from its inception to. PLM is a holistic approach to product development. It incorporates every aspect of a product's lifecycle - from innovation through to repurposing, reuse and. As we've laid out, the 5 stages of the PLC (or product life cycle) are development, introduction, growth, maturity, and decline. The 4 stages of the product life cycle are introduction, growth, maturity, and decline. Learn how to leverage this into your business strategy. Product Lifecycle Management (PLM) is the set of processes and technologies used to manage the entire lifecycle of a product, from conception to disposal. The Stages Of The Traditional Product Life Cycle · Product Life Cycle Phase 1: Introduction Stage · Product Life Cycle Phase 2: Growth Stage · Product Life. What are the 4 Phases of a Product Life Cycle? · Life Cycle Phase 1: Introduction · Life Cycle Phase 2: Growth · Life Cycle Phase 3: Maturity · Life Cycle Phase. Product lifecycle refers to the stages a new product goes through from concept through end-of-life. Product Lifecycle Management (PLM) solutions help manage. The product lifecycle has four stages: introduction, growth, maturity, and decline. See how your product can thrive in each stage. Two pre-release lifecycle phases — Alpha and Beta — are designed to allow customers to begin safely testing the latest Particle technology and providing us with. When the product reaches the maturity stage, the marketing focus is on differentiating the product from competitors and finding new applications or markets. A model for the product sales lifecycle, with the assumption of four major phases: introduction, growth, maturity, and decline. Curve of sales as a function of. Optimize your product' s design and marketing strategies at each stage of its life cycle for maximum profitability and success.

How Does Auto Trade In Work

How does trading in a car with a loan work? · Find your loan balance: Determine how much you owe on your current financed vehicle. · Estimate your trade-in value. Can I Trade In a Car With Negative Equity? If you're interested in trading in your upside-down car, some dealerships will offer to pay off the loan for you. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. The purchaser still owes $1, on the trade-in vehicle, but the dealer agrees to pay off this remaining balance to the bank. Sales tax exemption is still. When you trade in a car, you use an existing vehicle that you'll no longer need to offset the price of a new car. The dealer essentially buys the car by. Often called a car trade-in tax credit, these savings don't come from a government incentive program but simply from how tax is calculated. When you trade in a. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. It all depends on how much work you are willing to do. While trading in a car to the dealership is much more convenient, you will pay for that convenience in. Trading in a vehicle is a common way for drivers to get rid of their vehicle as they purchase their next ride. You'll simply choose your next model out of our. How does trading in a car with a loan work? · Find your loan balance: Determine how much you owe on your current financed vehicle. · Estimate your trade-in value. Can I Trade In a Car With Negative Equity? If you're interested in trading in your upside-down car, some dealerships will offer to pay off the loan for you. Essentially, what you do is sell your used car to the dealer, and the amount they pay gets taken off the value of whichever vehicle you want to buy. The purchaser still owes $1, on the trade-in vehicle, but the dealer agrees to pay off this remaining balance to the bank. Sales tax exemption is still. When you trade in a car, you use an existing vehicle that you'll no longer need to offset the price of a new car. The dealer essentially buys the car by. Often called a car trade-in tax credit, these savings don't come from a government incentive program but simply from how tax is calculated. When you trade in a. Some car dealers advertise that, when you trade in your car to buy another one, they'll pay off the balance of your loan. No matter how much you owe. It all depends on how much work you are willing to do. While trading in a car to the dealership is much more convenient, you will pay for that convenience in. Trading in a vehicle is a common way for drivers to get rid of their vehicle as they purchase their next ride. You'll simply choose your next model out of our.

Usually we pick your car up at your location in hours and you're paid at the same time. See what your car is worth now! How Does Trading in a Car Work? A: Yes, you can. If you have positive equity on the car (as in it's worth more than what you currently owe), you can trade it in easily. The dealer. Trading in your car with Enterprise is a simple process. Be a smart shopper. Be prepared. Schedule a dealership visit. Submit the results of your online car. Just remember, if you owe money on the trade, getting a new car must include paying off the old car. Selling or trading is a decision of what makes the most. The dealership will deduct what you owe from trade value applied toward vehicle, and pay off car to lender. Say your trading in a car worth $ You'll need to gather information about the vehicle's current value, prepare the vehicle for sale, and negotiate a price with the dealer. How do we accomplish that? Through our trade-in program, you'll be able to cash in your car and get money towards a new one. And there are no loopholes or. When trading in a car with a loan balance, the car dealership that you are purchasing the new vehicle from would take over the loan, essentially buying the car. Fortunately, dealerships don't typically perform a credit check when you trade-in your car. The vehicle valuation step leaves lenders and credit scores out of. Before you can trade in your car, you'll need to have the title. The title is legal proof of ownership. If you don't have the title, the dealership won't be. If accepted, the trade-in value is then deducted from the cost of your new car. For example, if the car you wish to buy is priced at $15,, and the dealership. Typically, a trade-in is beneficial for drivers who are hoping to receive credit toward a new vehicle they would like to buy or lease. To determine the amount. However, keep in mind that trading your car in does not mean that you're no longer obligated to pay the remaining loan balance; you will still have to pay that. Trading in a vehicle that you still owe money on takes a few extra steps. Knowing how much you still owe on your vehicle, as well as the value of the vehicle. How Does Rolling Over a Car Loan Work? Trading in a vehicle that you still owe money on means you will need to roll over the old loan into the new, combining. Often called a car trade-in tax credit, these savings don't come from a government incentive program but simply from how tax is calculated. When you trade in a. Here's How It Works: You take the selling price of the vehicle you're buying, add tax and title fees, subtract your trade- in allowance, then add your. However, dealership can make a discount through the auction and transport fees that would be paid when buying a car at auction. At Clement Pre-Owned, we strive. How Does Trading in a Vehicle with Negative Equity Work? Trading cars, coins and calculator . Negative equity while car trade-in means that you owe your. By trading in your current vehicle, you can use its value towards your new vehicle purchase. This option is offered by most dealerships.

What Is Hedge Fund Trading

Hedge Funds are sophisticated investment avenues, encompassing a wide array of trading strategies across different asset classes and markets. They utilize. Since most hedge fund managers are not restricted by mandate to trade only certain assets in specific markets, they often trade many different markets in. Hedge funds pool investors' money and invest the money in an effort to make a positive return. Hedge funds typically have more flexible investment strategies. How do hedge funds develop trading strategies? · Research: The first step in strategy creation is researching the markets to find trading edges. · Defining the. For the latest trades, see the Insider Trading Tracker. Most followed insider stocks: Tesla - TSLA; Apple - AAPL. Hedge Fund Trading Strategies Hedge Funds employ several strategies, usually using leverage. Hedge Funds also invest in various financial instruments. What are hedge funds? Hedge funds pool money from investors and invest in securities or other types of investments with the goal of getting positive returns. Normally, the prices of the bonds and shares trade in a close relationship. Sometimes bond and stock market conditions cause the prices to get out of line. Hedge fund strategies are classified by a combination of the instruments in which they are invested, the trading philosophy followed, and the types of risks. Hedge Funds are sophisticated investment avenues, encompassing a wide array of trading strategies across different asset classes and markets. They utilize. Since most hedge fund managers are not restricted by mandate to trade only certain assets in specific markets, they often trade many different markets in. Hedge funds pool investors' money and invest the money in an effort to make a positive return. Hedge funds typically have more flexible investment strategies. How do hedge funds develop trading strategies? · Research: The first step in strategy creation is researching the markets to find trading edges. · Defining the. For the latest trades, see the Insider Trading Tracker. Most followed insider stocks: Tesla - TSLA; Apple - AAPL. Hedge Fund Trading Strategies Hedge Funds employ several strategies, usually using leverage. Hedge Funds also invest in various financial instruments. What are hedge funds? Hedge funds pool money from investors and invest in securities or other types of investments with the goal of getting positive returns. Normally, the prices of the bonds and shares trade in a close relationship. Sometimes bond and stock market conditions cause the prices to get out of line. Hedge fund strategies are classified by a combination of the instruments in which they are invested, the trading philosophy followed, and the types of risks.

Although hedge funds generally use derivative financial instruments (securities like options whose value is "derived" from the value of other, underlying. The most common strategies include short-selling, reliance on leverage (i.e. borrowed funds), financial derivative instruments, and arbitrage strategies. Mutual. Systematic traders are, essentially, hedge funds that trade any macroeconomic market (FX, commodities, fixed income, equity indices etc) through an algorithmic. Leverage: When it comes to leverage, hedge funds use aggressive techniques to manage their assets. Most of its funds are sourced from pensions, life insurance. A hedge fund is an investment fund created by accredited individuals and institutional investors for the purpose of maximizing returns. They can trade in credit default swaps. That stuff is just not typically open to mutual funds.” How do hedge funds compare with other investments? Renowned. These funds use different types of trading techniques because of the securities and assets they invest in. They invest in equities, debt and also derivatives. For example, the fund manager might buy $1 million of shares in ABC Pharmaceuticals Inc. because it's the leader in the industry while shorting XYZ Pharma Orp. What is a hedge fund? A hedge fund is a pooled investment fund that usually trades in liquid assets. This allows for more complex trading along with risk. an investment fund that trades large amounts of shares, currencies, etc. to take advantage of both rising and falling prices, for example by shorting. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies. Hedge funds are subject to the same trading reporting and record-keeping requirements as other investors in publicly traded securities. They are also. Hedge Fund Definition: A hedge fund is an investment fund that raises capital from institutional and accredited investors and then invests it in financial. The prime broker typically allocates trade tickets between the domestic fund and the offshore fund. For hedge fund managers seeking to establish both a domestic. Leading the Pack with Highly Adaptable Trading Technology for Hedge Funds · FlexTRADER EMS. Optimized for complex strategies, FlexTrader EMS facilitates high-. Hedge funds trade stocks like any other investor, though their financial power and know-how allow them to optimize such trades in every respect. For example. Hedge funds vary in terms of investment strategies, returns, volatility and risk. Hedge fund managers typically are highly specialized and trade within their. A hedge fund is an unregulated alternative investment vehicle that uses a wide selection of strategies and financial instruments (unavailable to regulated. Hedge Fund Analyst Job Description · Base salary starts around $K – $K and increases each year, and your bonus might be 0%, %, or even % of that. A hedge fund isn't a specific type of investment. Rather, it is a pooled investment structure set up by a money manager or registered investment advisor and.

Crypto Etf

Invesco's exchange-traded funds (ETFs) give investors access to digital assets, including cryptocurrencies like bitcoin and blockchains like Ethereum. CRYP, Betshares Crypto ETF, aims to track the performance of an index that provides exposure to global companies in crypto economy. Click to see more information on Cryptocurrency ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. A surge of new crypto ETFs have been launched to make it easier for investors to buy cryptocurrencies without the headaches, security risks and complexity. Our Schwab Crypto Thematic ETF is designed to deliver global exposure to companies that may benefit from the development or utilization of cryptocurrencies . Evolve Cryptocurrencies ETF (TSX: ETC) provides investors with a simple and efficient way to access cryptocurrencies - bitcoin and ether. The Bottom Line. Crypto ETFs allow institutional and everyday investors to speculate on the price of digital currencies. Nevertheless, it's essential to. After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. The Schwab Crypto Thematic ETF invests in a portfolio of securities that are based on a theme and its performance may suffer if such theme is not correctly. Invesco's exchange-traded funds (ETFs) give investors access to digital assets, including cryptocurrencies like bitcoin and blockchains like Ethereum. CRYP, Betshares Crypto ETF, aims to track the performance of an index that provides exposure to global companies in crypto economy. Click to see more information on Cryptocurrency ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. A surge of new crypto ETFs have been launched to make it easier for investors to buy cryptocurrencies without the headaches, security risks and complexity. Our Schwab Crypto Thematic ETF is designed to deliver global exposure to companies that may benefit from the development or utilization of cryptocurrencies . Evolve Cryptocurrencies ETF (TSX: ETC) provides investors with a simple and efficient way to access cryptocurrencies - bitcoin and ether. The Bottom Line. Crypto ETFs allow institutional and everyday investors to speculate on the price of digital currencies. Nevertheless, it's essential to. After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. The Schwab Crypto Thematic ETF invests in a portfolio of securities that are based on a theme and its performance may suffer if such theme is not correctly.

A bitcoin futures exchange-traded fund (ETF) issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts. After a major regulatory win, Bitcoin and other digital currencies are booming. These bitcoin and crypto ETFs will give you exposure to the space. Click to see more information on Cryptocurrency ETFs including historical performance, dividends, holdings, expense ratios, technicals and more. Buy and sell crypto like bitcoin and ethereum, starting with as little as $1. Trade crypto 7 days a week—23 hours a day—on our website and mobile app. Spot crypto ETPs (FBTC and FETH) are for investors with a high risk tolerance. FBTC and FETH each offer an investment in a single cryptocurrency. A crypto exchange-traded fund is a type of investment fund that tracks the spot market price or futures contract price of one or more cryptocurrencies. Cryptocurrency stocks, ETFs, and coin trusts. To gain exposure without directly owning and storing cryptocurrencies, you could consider securities that. Blockchain ETFs provide an opportunity to invest in the fast-growing crypto market via ETFs, though. The indices tracked by such ETFs are composed of companies. Fund details, performance, holdings, distributions and related documents for Schwab Crypto Thematic ETF (STCE) | The fund's goal is to track as closely as. Cryptocurrency ETFs can provide a low cost of ownership for cryptocurrencies, but there are limits to the types of funds because of regulatory issues. Learn more about Crypto ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. WHAT IS BITCOIN? Bitcoin is the first form of internet-native money to gain global adoption and the world's largest cryptocurrency.¹. Exchange-traded funds, better known as an ETFs, are similar in many ways to mutual funds. They generally track the price of an asset (like gold) or basket of. The iShares Blockchain and Tech ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies that are involved in the. The world's largest crypto index fund manager. We believe everyone should have easy access to crypto assets. Discover how we can be your trusted partner. Targeting the performance of the world's largest cryptocurrencies. Available in brokerage accounts. These funds invest in cryptocurrency futures. Crypto ETF offers exposure to the digital assets and blockchain economy, including exchanges, payment gateways, mining, software services and equipment. It's possible to purchase ETFs that track the two biggest cryptocurrencies 2, Bitcoin and Ethereum, or a combination of the two. Crypto ETFs can be a convenient way to invest in Cryptocurrency through your regular brokerage account, without the hassle of direct crypto ownership or. The Hashdex Nasdaq Crypto Index ETF is a fully physically backed Exchange Traded Fund (ETF). The objective of this product is to offer investors a simple.

Is Lending Tree Or Quicken Loans Better

Online mortgage lenders are more likely than brick-and-mortar lenders to offer lower fees and interest rates as they have fewer overhead expenses. Shop around for lender offers. Mortgage shoppers save serious money versus those that don't shop around, according to LendingTree data. Collect loan estimates. While both provide online applications, one is a better pick for those who want to compare their mortgage options. Quicken Loans, and more Today, the company is well known as a national lending powerhouse, and has funded more than $ billion since its inception. LendingTree's primary competitors are SoFi, LendingClub, Quicken Loans and 10 more. Competitors. View 13 LendingTree competitors here. Acquisitions. View Personal loan lenders at a glance ; Achieve: Best for debt consolidation. achieve · 5, · % - % · 24 to 60 months ; Best Egg: Best for quick funding. Quicken Loans is the top lender in the world so of course it is trustworthy. With Rocket Mortgage you will have a faster approval time. Quicken. Quicken Loans, LLC. Industry: Finance > Banking Credit and Lending. Global Rank loans, retirement, credit reports, and so much more. Company: Bankrate, LLC. LendingTree offers several benefits, and borrowers who know how to make the most of the service might just walk away with a better mortgage deal than they would. Online mortgage lenders are more likely than brick-and-mortar lenders to offer lower fees and interest rates as they have fewer overhead expenses. Shop around for lender offers. Mortgage shoppers save serious money versus those that don't shop around, according to LendingTree data. Collect loan estimates. While both provide online applications, one is a better pick for those who want to compare their mortgage options. Quicken Loans, and more Today, the company is well known as a national lending powerhouse, and has funded more than $ billion since its inception. LendingTree's primary competitors are SoFi, LendingClub, Quicken Loans and 10 more. Competitors. View 13 LendingTree competitors here. Acquisitions. View Personal loan lenders at a glance ; Achieve: Best for debt consolidation. achieve · 5, · % - % · 24 to 60 months ; Best Egg: Best for quick funding. Quicken Loans is the top lender in the world so of course it is trustworthy. With Rocket Mortgage you will have a faster approval time. Quicken. Quicken Loans, LLC. Industry: Finance > Banking Credit and Lending. Global Rank loans, retirement, credit reports, and so much more. Company: Bankrate, LLC. LendingTree offers several benefits, and borrowers who know how to make the most of the service might just walk away with a better mortgage deal than they would.

Whereas sites like LendingTree and Zillow act as lead generators, sending your loan request to multiple mortgage providers, Rocket Mortgage is an actual lender. Personal loan lenders at a glance ; Achieve: Best for debt consolidation. achieve · 5, · % - % · 24 to 60 months ; Best Egg: Best for quick funding. Quicken Loans, now Rocket Mortgage, has solidified itself as an industry leader by leading the movement toward online-only mortgages. Its mortgage approval. Lending Tree · Motley Fool · Gabi Insurance · Lexington Law · apelman.online · Quicken Loans · apelman.online · Mortgage Training Centre. Rocket Mortgage and Quicken Loans are the exact same thing. They operate under both names. They have good service, and excellent tools, but. Not only do companies such as Quicken Loans and LoanDepot offer more control more loans and increase revenue per loan with cheaper, faster and automated. Competitive Landscape Given LendingTree's presence alongside companies like LendingClub, Quicken Loans loans, student refinances, credit cards and more. Hey guys, I'm looking for a mortgage company so far I looked at going to a big bank like Bank of America and Wells Fargo but what about all these onli. Take a look at the easy interface, clear calls to action, and variety of tools featured on the Quicken Loans website. Studying the lender that spends more than. Quicken Loans – Most Customizable Loans · LendingTree – Best Marketplace · Navy Federal – Best In-person Lender for Military Members · Guild Mortgage – Best for. Rocket Loans can be a great option for borrowers with decent credit who want flexible loan amounts and a fast application process. Searching for a loan to buy a home? These best online mortgage lenders have some of the best rates; we compare with pros, cons, and more. Is Quicken the best mortgage lender for you? If you choose Quicken's Rocket Mortgage for your loan, you're in good company. This Detroit-based lender has. If you're comparing multiple lenders, LendingTree is a good place to start your search. Use our LendingTree review to decide if it's right for you. Quicken Loans Review · Better Mortgage Review This, combined with LendingTree's easy application process, makes these loans more accessible to borrowers. LendingTree helps you get the best deal possible on your loans. By providing multiple offers from several lenders, we show your options, you score the win. Quicken. I want to. Manage My Personal Finances. Save more towards my goals Lending Tree. By reducing the term of your loan, you'll take advantage of. Quicken Loans Review · Better Mortgage Review This, combined with LendingTree's easy application process, makes these loans more accessible to borrowers. Lean on Quicken Loans for help with your home buying journey. We also offer personalized solutions to access cash, purchase a home, refinance and more. Less paperwork and eClosings are just two examples of how we simplify mortgages. We make home more affordable.

Fastest Way To Pay Off Auto Loan

Paying off a loan early: five ways to reach your goal · Make a full lump sum payment. Making a full lump sum payment means paying off the entire auto loan at. You can use the auto loan early payment calculator backward to find out how much you'll be spending to pay off the car loan within a specific period. In doing. 5 Techniques For How To Pay Off Your Car Faster. Reduce Your Term Length; Try Out A New Budget; Look For A Side Gig; Make Extra Payments; Refinance. Can You Pay Off a Car Loan Early: How to Guide · Make Bi-Weekly Payments – · Round Up Your Payment Each Month – · Make One Extra Payment Each Year in One Lump Sum. How to Pay Off a Vehicle Loan Early · Bi-Weekly Payments: Make your car loan payments bi-weekly and pay thirteen months instead of twelve. · Round-Up Monthly. If you take on a loan that has a longer repayment term, it might have a lower interest rate but you could end up paying more in total interest than you would. Another way you can use rounding up to help you pay your car loan off faster is to round up on all your purchases. There are apps that allow you to round up all. Round Up Your Payments. Rounding up to the nearest 20, 50, or even dollars is a great way consistently make larger payments and eventually pay off your loan. I'd probably make it simple and just put an extra payment with your regularly scheduled monthly payment. To me you are more likely to be. Paying off a loan early: five ways to reach your goal · Make a full lump sum payment. Making a full lump sum payment means paying off the entire auto loan at. You can use the auto loan early payment calculator backward to find out how much you'll be spending to pay off the car loan within a specific period. In doing. 5 Techniques For How To Pay Off Your Car Faster. Reduce Your Term Length; Try Out A New Budget; Look For A Side Gig; Make Extra Payments; Refinance. Can You Pay Off a Car Loan Early: How to Guide · Make Bi-Weekly Payments – · Round Up Your Payment Each Month – · Make One Extra Payment Each Year in One Lump Sum. How to Pay Off a Vehicle Loan Early · Bi-Weekly Payments: Make your car loan payments bi-weekly and pay thirteen months instead of twelve. · Round-Up Monthly. If you take on a loan that has a longer repayment term, it might have a lower interest rate but you could end up paying more in total interest than you would. Another way you can use rounding up to help you pay your car loan off faster is to round up on all your purchases. There are apps that allow you to round up all. Round Up Your Payments. Rounding up to the nearest 20, 50, or even dollars is a great way consistently make larger payments and eventually pay off your loan. I'd probably make it simple and just put an extra payment with your regularly scheduled monthly payment. To me you are more likely to be.

If you have some spare money (and no higher-interest loans), there are plenty of benefits from paying off your auto financing. You can do this in either one or. The perks include less overall paid interest, avoiding becoming upside down on your loan in the future, and a decreased debt-to-income ratio. These perks. 1. Refinance your auto loan for a lower term. Auto refinancing is a great way to reduce your loan term and pay off the loan easily. How can I pay off my car loan faster? I would set an automatic payment through your bank. If for example your payment due is $/m and you want to add $/m to that, I would do. 1. Increase your monthly payments. Increasing the size of your monthly payment is a strategy that can help you pay down your auto loan quickly. Make Bi-Weekly Payments – Check with your lender first to ensure it's okay to use this technique; divide your monthly car payment by two, then make that payment. HOW TO PAY OFF YOUR CAR FASTER · Biweekly Payments – Instead of making your car payment once a month, split your monthly amount in half and pay that amount every. Disadvantages of Paying Off a Car Loan Early · If you don't have an emergency fund in place, larger car payments can put a lot of stress on your financial. Benefits of paying off your car loan early include lower interest paid overall, decreased chances of becoming upside down on your loan, a lower debt-to-income. The debt snowball method is a useful way to tackle outstanding debt by focusing on the lowest hanging fruit. Put simply, this strategy involves making minimum. Less Interest: Interest always makes up part of your monthly payments. You can't avoid it entirely, but you can end up paying considerably less by paying off. 5 Ways To Pay Off A Loan Early · 1. Make bi-weekly payments · 2. Round up your monthly payments · 3. Make one extra payment each year · 4. Refinance · 5. Boost your. Sign in to your online bank · Click Overview · Select the account from which you want to make the payment in full. · Click Accelerated repayment · Choose either the. While some car loans may offer the option to skip a payment, it's generally best to avoid doing so if your goal is to pay off the loan faster. Skipping payments. By following these tips, you can pay off your auto loans faster and get rid of that payment every month, so keep reading! How to Pay Off a Vehicle Loan Early · Bi-Weekly Payments – Check with your loan lender to make sure this technique is approved; divide your monthly payment in. From making smarter payment choices to rethinking your financial arrangements, here are five actionable ways to hasten your journey to a car loan-free life. Prepayment penalties guarantee interest income for the lender no matter when you pay off your loan, so confirm that you can make additional payments without it. In fact, paying off your car loan before the end of the loan term is a great way to reduce your interest payments! Paying off your loan early takes focus and.

Credit Cards That Can Have A Cosigner

U.S. Bank offers a variety of rewards credit cards, including cash back, travel and points rewards. You can compare and choose the best card that fits your. Adding a creditworthy co-signer on your student loan application can help you get approved, especially if you have limited credit history. It's fairly. Co-signing on a student loan or credit card means that you are taking responsibility for paying the loan or credit card balance in the event that the consignee. Student credit card: If you're in school, you can apply for a student credit card. These usually have low loan amounts to keep students from racking up a large. is a credit card you can trust. Apply today Sound Savers Youth Visa % APR1. Must have parent/guardian co-signer; Ages 15 - 17; Credit limits up to. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. If your relative or good friend has asked you to co-sign a credit card application, you may be wondering whether you can and if this is a good idea or not. can borrow money and pay it back, on time, with interest. That's why student credit cards have different credit requirements, which make them a good option. Applying for a credit card with a cosigner allows you to have a credit card in your own name; however, the cosigner (typically a parent or legal guardian) will. U.S. Bank offers a variety of rewards credit cards, including cash back, travel and points rewards. You can compare and choose the best card that fits your. Adding a creditworthy co-signer on your student loan application can help you get approved, especially if you have limited credit history. It's fairly. Co-signing on a student loan or credit card means that you are taking responsibility for paying the loan or credit card balance in the event that the consignee. Student credit card: If you're in school, you can apply for a student credit card. These usually have low loan amounts to keep students from racking up a large. is a credit card you can trust. Apply today Sound Savers Youth Visa % APR1. Must have parent/guardian co-signer; Ages 15 - 17; Credit limits up to. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. If your relative or good friend has asked you to co-sign a credit card application, you may be wondering whether you can and if this is a good idea or not. can borrow money and pay it back, on time, with interest. That's why student credit cards have different credit requirements, which make them a good option. Applying for a credit card with a cosigner allows you to have a credit card in your own name; however, the cosigner (typically a parent or legal guardian) will.

Extra rewards. Our rewards cards let you earn Loyalty Bonuses when you have a Truist checking or savings account. Becoming either a co-signer or a guarantor is a serious financial commitment that can have significant financial consequences for your credit reports and credit. When you apply for your first credit card, you might be surprised at what's required. Otherwise, you'll need a cosigner to be considered for a new card. If you plan to get a new loan yourself in the future, cosigning can be risky. How Many Credit Cards Should You Have? Evaluating Credit Card Reward. If you co-sign for someone, you assume the same level or responsibility for that debt that they the primary does. The account lands on your credit report the. Credit card: If you have a credit card, you might use it for purchases that you can pay off within the card's grace period (usually one billing cycle). Interest. This is why only a few major credit card issuers even allow co-signers for credit cards. If you have to have a co-signer to get a credit card, it signals to. may need for the future, such as a mortgage, car loan, or even a credit card. What steps should you take if you decide to cosign a private student loan? If. The liability can prevent co-signers from qualifying for another loan or credit card. If you co-sign a loan, you may be required to pay more than the loan. You can change it once each calendar month, or make no change and it stays the same. 0% † Intro APR for your first 15 billing cycles for purchases, and for any. A co-signer or co-borrower can help you get a personal loan if you don't qualify alone. Patelco Credit Union and SoFi are our top picks. If you can't show a source of income, such as a job, you'll need to have a cosigner on the card or ask to be an authorized user on a friend or relative's credit. Co-Signer: most lenders and credit card issuers will grant credit to someone who doesn't otherwise qualify if a relative or friend with a strong credit. Otherwise, you'll need a cosigner to be considered for a new card. Many credit cards have minimum credit score requirements—though some issuers make. A financial institution often requests that those with no credit history, or those who are under 21, have someone they trust cosign on the account. The cosigner. With the help of a co-signer or a guarantor, borrowers with low credit scores or limited credit history may be more likely to qualify for the credit they need. If you can't show a source of income, such as a job, you'll need to have a cosigner on the card or ask to be an authorized user on a friend or relative's credit. Adding a creditworthy co-signer on your student loan application can help you get approved, especially if you have limited credit history. It's fairly. Using a spouse as cosigner on a loan or credit card can bring about some unwanted financial challenges. Learn more about the pros and cons.

How Long To Rebuild Credit After Chapter 13

But it will take at least ten years. That's how long a Chapter 7 bankruptcy stays on your credit report. Most negative entries have very little. You can typically work to improve your credit score over months after bankruptcy. Most people will see some improvement after one year if they take the. Short Summary: · Typically, you can enhance your credit score within months after bankruptcy, with noticeable improvements as early as one year. Not true, and in fact, if you have a low credit score before you file for Bankruptcy, chances are that your credit score will dramatically improve after the. Capably managing your credit after bankruptcy could put you back above — the good-risk range — in as few as four years. Again, this means minimizing your. For Chapter 13, it often takes 12 to 18 months to start rebuilding your credit score. However, after 18 months, many debtors can refinance or restructure debt. It can take a year or two after your debts are discharged to see an improvement in your credit. A bankruptcy stays on your credit report for seven to 10 years. After bankruptcy, individuals can improve their credit scores within months by adhering to budgets, making timely payments, and opening new accounts. This bankruptcy type allows people with regular income to develop a repayment plan for part or all their debt. Chapter 13 bankruptcy is typically removed from. But it will take at least ten years. That's how long a Chapter 7 bankruptcy stays on your credit report. Most negative entries have very little. You can typically work to improve your credit score over months after bankruptcy. Most people will see some improvement after one year if they take the. Short Summary: · Typically, you can enhance your credit score within months after bankruptcy, with noticeable improvements as early as one year. Not true, and in fact, if you have a low credit score before you file for Bankruptcy, chances are that your credit score will dramatically improve after the. Capably managing your credit after bankruptcy could put you back above — the good-risk range — in as few as four years. Again, this means minimizing your. For Chapter 13, it often takes 12 to 18 months to start rebuilding your credit score. However, after 18 months, many debtors can refinance or restructure debt. It can take a year or two after your debts are discharged to see an improvement in your credit. A bankruptcy stays on your credit report for seven to 10 years. After bankruptcy, individuals can improve their credit scores within months by adhering to budgets, making timely payments, and opening new accounts. This bankruptcy type allows people with regular income to develop a repayment plan for part or all their debt. Chapter 13 bankruptcy is typically removed from.

If you filed for Chapter 13 bankruptcy, it will leave its mark for up to seven years. When you go through bankruptcy it not only tanks your numerical score, it. Unlike a Chapter 7 bankruptcy, a Chapter 13 bankruptcy only appears on your credit report for 7 years. Like in a Chapter 7 your debts will begin dropping off. It can take the CRA up to 30 days to process the dispute, and it may require follow-up claims before it's corrected. If you need help with credit repair. Short Summary: · Typically, you can enhance your credit score within months after bankruptcy, with noticeable improvements as early as one year. Capably managing your credit after bankruptcy could put you back above — the good-risk range — in as few as four years. Again, this means minimizing your. Therefore, if you keep your open accounts in good standing, your credit scores could potentially improve within two years. Open a new line of credit. After some. Dispute any errors as soon as you spot them. It's not uncommon to find inaccuracies and unfair credit reporting. Note that your old bankruptcy should not appear. However, lenders will ask for your financial information, including whether you are employed, current debts and assets, in addition to obtaining credit reports. If you're talking about CH7, then in about days from date of filing you'll receive your discharge. After that, you'll want to check your. But it will take at least ten years. That's how long a Chapter 7 bankruptcy stays on your credit report. Most negative entries have very little. In most cases, a Chapter 13 bankruptcy stays on a credit report for up to seven years after the bankruptcy filing date. Once the seven years have passed, the. If a second bankruptcy is filed, then the first re-appears on your Equifax credit report, and both bankruptcies remain for 14 years after the discharge dates.”. A Chapter 7 bankruptcy is typically removed from your credit report 10 years after the date you filed, and this is done automatically. If Chapter 13, it will be on your report for up to seven years. Typically, a person's score will drop by around to points after a bankruptcy. However. A payment plan for a Chapter 13 bankruptcy can take years. So if you filed 5 years ago and you're ready to rebuild your credit, you really only have about 2. keep utilization under 30% · always make your payments · don't do any further hard checks · keep your secured credit card once you have a better. Before you file bankruptcy, you should understand the consequences. The bankruptcy will be reflected on your credit score for as long as 7-to years depending. How Long Will It Take for My Credit Score to Improve After Bankruptcy? You can usually work to improve your credit score 12 to 18 months after bankruptcy. With Equifax, a consumer proposal is reported for three years after your last payment. What if there is an error on my credit report? Credit bureaus maintain. The completed Chapter 13 bankruptcy, along with the accounts that were included in the program, should disappear from your credit reports about seven years.

Poly Matic Crypto

View live Polygon chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Latest news on Polygon (MATIC), an Ethereum token that powers the Polygon Network, a scaling solution for Ethereum. The price of Polygon (MATIC) is $ today, as of Aug 23 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. I hold a lot of Shib, but holding tight to my Poly n ADA. ️ 1 1 Trading for Polygon (MATIC) and Ethereum Goes Live on Zero-Fee Decentralized. Browse the latest Polygon (MATIC) cryptocurrency news, research, and analysis. Stay informed on Polygon prices within the cryptocurrency market. Polygon is a protocol and a framework for building and connecting Ethereum-compatible blockchain networks, aggregating scalable solutions on Ethereum, and. MATIC is the native token to the Polygon blockchain. View its tokenomics and how to purchase, stake, bridge, and swap your MATIC tokens. PolygonScan allows you to explore and search the Polygon blockchain for transactions, addresses, tokens, prices and other activities taking place on Polygon. Polygon's price today is US$, with a hour trading volume of $ M. MATIC is +% in the last 24 hours. It is currently % from its 7-day all-. View live Polygon chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Latest news on Polygon (MATIC), an Ethereum token that powers the Polygon Network, a scaling solution for Ethereum. The price of Polygon (MATIC) is $ today, as of Aug 23 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. I hold a lot of Shib, but holding tight to my Poly n ADA. ️ 1 1 Trading for Polygon (MATIC) and Ethereum Goes Live on Zero-Fee Decentralized. Browse the latest Polygon (MATIC) cryptocurrency news, research, and analysis. Stay informed on Polygon prices within the cryptocurrency market. Polygon is a protocol and a framework for building and connecting Ethereum-compatible blockchain networks, aggregating scalable solutions on Ethereum, and. MATIC is the native token to the Polygon blockchain. View its tokenomics and how to purchase, stake, bridge, and swap your MATIC tokens. PolygonScan allows you to explore and search the Polygon blockchain for transactions, addresses, tokens, prices and other activities taking place on Polygon. Polygon's price today is US$, with a hour trading volume of $ M. MATIC is +% in the last 24 hours. It is currently % from its 7-day all-.

Polygon (MATIC) is a cryptocurrency. Polygon has a current supply of 10,,, with 9,,, in circulation. The last known price of. What is Polygon (MATIC). Polygon is a Layer 2 scaling solution for the Ethereum blockchain that aims to improve transaction speeds and cost. Polygon achieves. Polygon Crypto Forecast for October Forecasts suggest the MATIC price could fluctuate between $ and $ in October. Based on various factors. Crypto Contender? apelman.online•8 days ago•. 0. LTCMATIC. Polymarket wagers on Harris defeating Trump. apelman.online•9 days ago•. 0. MATIC. Best Crypto to Buy. Explore MATIC. MATIC is the currency of Polygon that enables users to interact with tens of thousands of dApps in our ecosystem. Learn More · Govern. POLYFAM! In the next few posts we are going to #matic #polygon #polygonnetwork #polygoncrypto #layer2 #crypto #cryptocurrency #cryptocurrencynews. The Polygon (MATIC) token, however, is Polygon's native cryptocurrency. How Polygon works. The Ethereum blockchain can perform a limited number of transactions. Polygon is very likely to play a key role in Ethereum's journey to full scalability. This cryptocurrency project also has a lot of major partnerships. migration szn is here get the scoop on the MATIC to POL upgrade! the panel will be stacked, info will be flowing and Polygon will be cooking set your. According to data provided by Dune Analytics, the total number of bets on Polymarket surpassed the million mark Polygon MATIC. August 1, at pm. MATIC is the network's native cryptocurrency, which is used for fees, staking, and more. You can buy or sell MATIC via exchanges like Coinbase. The Ethereum. - The live price of MATIC is $ with a market cap of $B USD. Discover current price, trading volume, historical data, MATIC news. Polygon (formerly Matic Network) is a blockchain platform which aims to create a multi-chain blockchain system compatible with Ethereum. Polygon (MATIC/POL) is both a cryptocurrency and blockchain scaling platform. Polygon connects and grows Ethereum-compatible blockchain networks. Matic also happens to be a cryptocurrency on the Ethereum network. The difference is all about the blockchain. Despite being related projects--Polygon is built. What is Polygon? Read our guide to MATIC and start trading cryptocurrency on Kraken–the secure digital asset exchange. DApps on Polyong enable DeFi use cases like trading, borrowing and lending, prediction markets, crypto derivatives, synthetic assets, NFTs, and more. R. I hold a lot of Shib, but holding tight to my Poly n ADA. ️ 1 1 Trading for Polygon (MATIC) and Ethereum Goes Live on Zero-Fee Decentralized. Using Polygon, developers can easily connect Ethereum-compatible blockchain apps into its network to meet the rising scaling demand. Developers can choose. POL page: apelman.online OverviewFundraisingMarkets The MATIC token is used for blockchain governance, staking, and gas fees.

Lose Nose Fat

Aging results in the loss of soft tissue and fat throughout the body, including the nose. This volume loss can lead to a deflated or hollowed appearance, making. Ways to reduce facial fat include exercising regularly, eating a balanced diet rich in whole fruits and vegetables, limiting processed and sugary foods, and. Exercising, drinking water, sweating all the oil out of your pours and less intake of salt will slim the nose. Depending on people's face shape. Detoxifying Firming Skin Safe Loss Weight Body Shaping Lose Belly Fat-Burner Nose-Clips Firming Skin Cream for Face Body Care-Tightening Lotion Nose. Now of course I'm not saying don't ever train – there are significant benefits to exercise and lifting weights that will benefit your body fat percentage – but. 4 Best exercises! Get rid of nose fat, nose tip fat, bulbous nose tip, slim down fat nose naturally. · 7 New Nose Exercises reshape big nose and Lose nose fat. Make Nose Smaller, Sharper | Fix Fat, Round Nose | Slim Down Your Nose Fat Reshape, Sharpen Your Nose, Reduce Fat Nose Without Surgery. M posts. Discover videos related to Ways to Lose Nose Fat on TikTok. See more videos about Reduce Fat Nose, Fat on Nose, Fat Nose Exercises, Gotta Fat. Nose Fat Removal · How Long Your Nose Stays Blocked After Rhinoplasty | Nasal Packing Removal | Kyra Aesthetic Clinic · How Long Your Nose Stays Blocked After. Aging results in the loss of soft tissue and fat throughout the body, including the nose. This volume loss can lead to a deflated or hollowed appearance, making. Ways to reduce facial fat include exercising regularly, eating a balanced diet rich in whole fruits and vegetables, limiting processed and sugary foods, and. Exercising, drinking water, sweating all the oil out of your pours and less intake of salt will slim the nose. Depending on people's face shape. Detoxifying Firming Skin Safe Loss Weight Body Shaping Lose Belly Fat-Burner Nose-Clips Firming Skin Cream for Face Body Care-Tightening Lotion Nose. Now of course I'm not saying don't ever train – there are significant benefits to exercise and lifting weights that will benefit your body fat percentage – but. 4 Best exercises! Get rid of nose fat, nose tip fat, bulbous nose tip, slim down fat nose naturally. · 7 New Nose Exercises reshape big nose and Lose nose fat. Make Nose Smaller, Sharper | Fix Fat, Round Nose | Slim Down Your Nose Fat Reshape, Sharpen Your Nose, Reduce Fat Nose Without Surgery. M posts. Discover videos related to Ways to Lose Nose Fat on TikTok. See more videos about Reduce Fat Nose, Fat on Nose, Fat Nose Exercises, Gotta Fat. Nose Fat Removal · How Long Your Nose Stays Blocked After Rhinoplasty | Nasal Packing Removal | Kyra Aesthetic Clinic · How Long Your Nose Stays Blocked After.

Because there are no fat cells, gaining or losing weight does not have a direct Answering the question of whether your nose gets smaller when you lose. Jose Barrera San store, Buccal Fat Removal Before and After Richard Zoumalan store, Does losing weight affect your nose Quora store, Lose Nose Fat Get Slim Nose. Your nose, which is comprised of bone, soft tissue/skin, and cartilage, may change shape as you age. The structures and skin of the nose lose strength with. Your drinking habits are crucial for your health and can be particularly important if you're looking to lose facial fat. Studies have shown that regular. In this article, we'll walk you through the best contouring techniques, photo tricks, and exercises to make your nose look slimmer. Cocaine users can lose their sense of smell, and since cocaine use destroys the lining of the nose, the normal production and propagation of mucous blood to the. Buy Slimming Nose Lose Weight Fast Nasal Stick Breathe Nasal Inhaler Body Slimming Detox Fat Burner Weight Loss Beauty Health at Aliexpress for. Comments1K · 7 New Nose Exercises reshape big nose and Lose nose fat. Fix pointy nose and get nose tip up. · 5 Best steps!! How to lift your nose. Buccal fat reduction surgery helps reduce fullness in your face and highlights your cheekbones. This procedure is also called a cheek reduction. Follow. lose nose fat. #reels #explore #trendingreels #nose #noseexercise #nostrils #beforandafter #boyaglowup #l more. Hello, You can do some facial exercises to improve your nose. apelman.online by pinching your nose with your thumb and index finger very gently, and lifting it. Does losing face fat store change your nose shape, Will weight loss make my nose look thinner or do I need to store. When you lose weight, where does all that fat go? And what does it have to do with my nose? The answer will surprise you. Turns out, the majority of fat is. 7 New Nose Exercises reshape big nose and Lose nose fat. Fix pointy nose and get nose tip up. M views 3 years ago. boysglowupguidee on April 9, "NOSe Exercise to Lose NOSE Fat . #reels #explore #trendingreels #noseexercise #nostrils". Nose exercise to lose nose fat ‼️ #fitness#motivation#gym#homeworkout #bodybuilding #jawlinegoals#yt. Ear nose and throat A big serving of potatoes or pasta, served with high saturated fat butter, sour cream or creamy sauces will not help you lose weight. How Do I Lose Nose Fat · Exercises to Lose Nose Fat · Lose Nose Fat for Men · Flat Nose Glow Up · Nose Exercise for Flat Nose Boys. Nose exercise to lose nose fat ‼️ #fitness#motivation#gym#homeworkout #bodybuilding #jawlinegoals#yt. Eternxlkz · DRESS! #nosetransformation #noseslimmingtips #noseslimminghack #nosehack #nosefillercheck #noseclip #noseexercises Lose Nose Fat Exercise · How to.

1 2 3 4 5